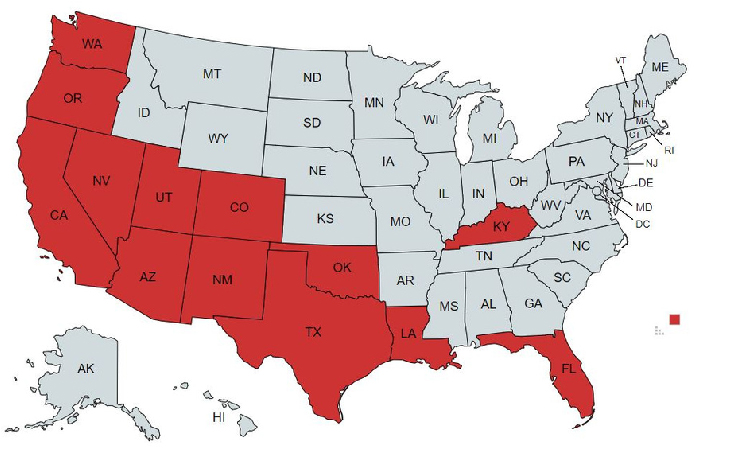

Territories We Serve: AZ, CA, CO, FL, KY, LA, NM, NV, OK, OR, TX, UT, WA

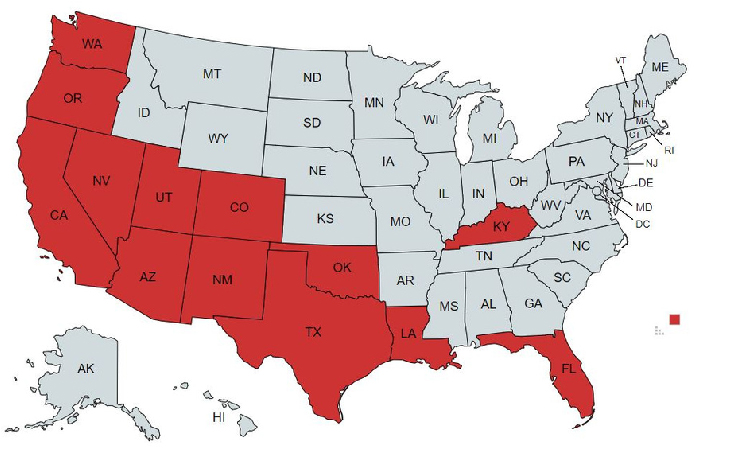

Territories We Serve: AZ, CA, CO, FL, KY, LA, NM, NV, OK, OR, TX, UT, WA

I’m Jeff from Inspiron Trucking Services, and today, I’ll provide you with seven essential tips, along with a bonus tip, to help you lower your insurance rates, streamline the process, and expedite it.

Let’s delve into strategies for reducing your insurance rates, the factors influencing these rates, and how you can effectively manage them, both in the short and long term.

1. Leverage Your Experience:

Insurance carriers value experience, whether it’s your driving expertise or your business acumen. Most carriers typically require drivers to have a minimum of two years’ experience. While some may accept less experience, this could result in higher premiums. Newer, less experienced drivers tend to contribute to more claims, impacting rates significantly.

However, the longer you’ve been in the industry, gaining experience as both a business owner and a driver, the more likely you are to secure credits and discounts.

2. Transparency Is Key:

Being honest and forthright with your insurance agent is crucial. Our role is to present your company in the best possible light to underwriters, encouraging them to offer you favorable terms. Providing complete information is essential, as withholding details can limit our ability to negotiate on your behalf.

If you have past claims or violations, it’s better to address them openly and work on solutions to minimize future issues. We want to assist you in resolving any problems, not hiding them.

3. Specify Your Operations:

Clearly define your operations by detailing the commodities you transport, your travel radius, and the cities you frequent. Underwriters use this information to assess your risk profile and determine your rates.

Different carriers have varying preferences, such as long-haul or local drivers. Tailoring your information to match the right carrier’s criteria can result in better rates.

4. Maintain a Clean Loss History:

Having fewer claims is a surefire way to keep insurance rates down. Carriers increase rates to compensate for losses, so minimizing claims is essential.

5. Manage Basic Scores:

Newer companies and drivers may not be familiar with basic scores, but carriers scrutinize them closely. These scores include out-of-service violations, driver violations, maintenance issues, and logging discrepancies. Maintaining clean scores can positively impact your rates.

As your fleet grows, keeping these scores in check becomes even more critical, as violations can result in downtime and additional expenses.

6. Timely Submission of Information:

Provide your agent with all necessary information promptly. Faster submissions ensure that your application doesn’t get stuck at the bottom of an underwriter’s pile. Underwriters prioritize complete submissions, increasing the chances of securing coverage quickly.

7. Credit and Financial Stability:

Your credit and business credit can also influence your insurance rates. Some carriers factor in credit when determining rates, so maintaining good credit can lead to lower premiums. Additionally, your financial stability, including profit and loss reports and tax returns, plays a role in rate calculations.

8. Set Realistic Expectations:

It’s important to be honest and realistic from the beginning. If we ask about your current premium, it’s not to undercut it but to assess the viability of finding a better rate. We’ll always be straightforward with you. If you already have a highly competitive rate, we’ll let you know.

Clear communication and realistic expectations are key to a successful partnership. Misaligned expectations can lead to frustration and wasted effort.

Bonus Tip: Avoid Multiple Quotes Simultaneously:

Contrary to common belief, seeking multiple quotes from different agents simultaneously can be counterproductive in the commercial insurance world. Typically, only the first agent to submit a quote request will receive an offer. Furthermore, submitting multiple applications with variations in details can raise red flags with underwriters, potentially complicating the process.

Instead, interview potential agents to find one that aligns with your needs. Ensure they have experience in trucking insurance, are responsive, and have access to a range of carriers. Once you’ve chosen an agent, allow them to negotiate on your behalf, increasing your chances of securing the best rate quickly.

In conclusion, by following these tips and working closely with your insurance agent, you can improve your chances of securing affordable insurance rates for your trucking company. For more information on how to lower your trucking insurance premiums, contact our team and talk to a Trucking Expert today.

PREVIOUS POST

« How to Find the Best Trucking Insurance Agent