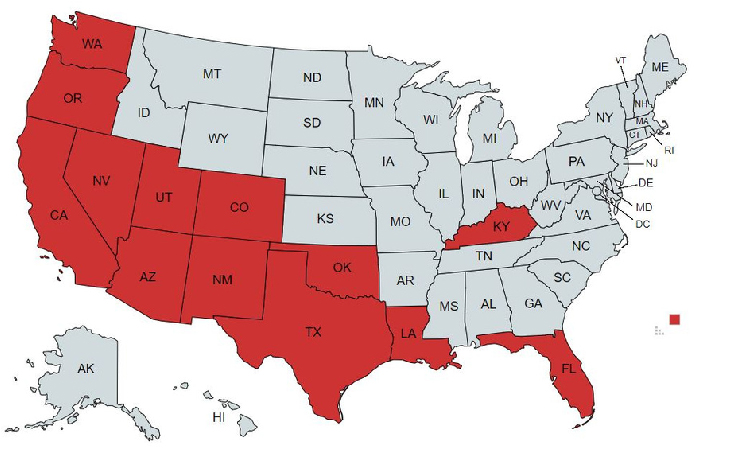

Territories We Serve: AZ, CA, CO, FL, KY, LA, NM, NV, OK, OR, TX, UT, WA

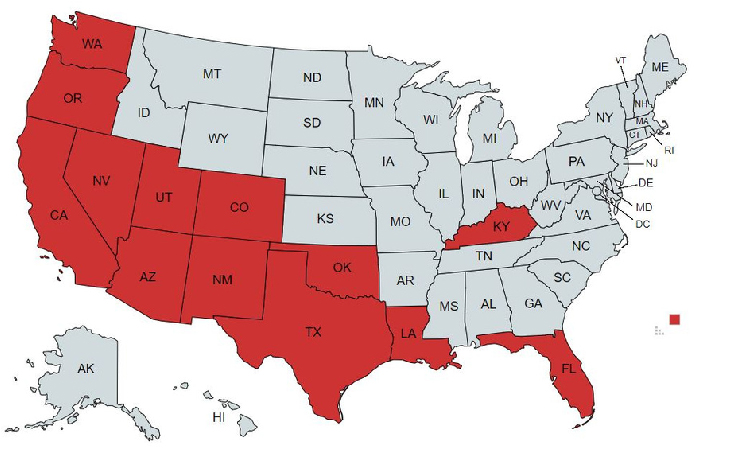

Territories We Serve: AZ, CA, CO, FL, KY, LA, NM, NV, OK, OR, TX, UT, WA

There are Surety Bonds, Fidelity Bonds, Contractors License Bonds, Title Bonds and the list goes on and on…. The simplest definition is a BOND is way to guarantee something. It can be a performance guarantee, that ensures a contractor will complete the job. It can be a sales tax bond that ensures the retailer will collect and pay the sales tax for items they sell. It can be a way to secure a debt to ensure it is repaid.

Inspirion Insurance Solutions can help you find the right bond to fit your needs or requirements.

Choose the link below to access our 1-2 page applications to quote and issue your new Bond in less than 3 minutes.

Your Bond will be emailed to you within minutes.

A surety bond is a legally binding contract among three parties: the principal (the party required to obtain the bond), the obligee (the party requesting the bond), and the surety (the company providing the bond). It ensures that the principal fulfills their obligations as specified in the bond.

Surety bonds are often required by government agencies, industry regulators, or clients to guarantee that you will fulfill your contractual or legal obligations. They provide financial protection and reassurance to the obligee.

The cost of a surety bond, known as the premium, varies depending on factors like the type of bond, the bond amount, the applicant’s credit history, and the bonding company. Premiums are typically a percentage of the bond amount, usually ranging from 1% to 15%.

Surety bonds come in various types, including license and permit bonds, contract bonds, court bonds, fidelity bonds, and more. Each type serves a different purpose, from licensing compliance to construction project guarantees.

To obtain a surety bond, you typically need to contact a surety bond provider or agency. You’ll complete an application, provide financial information, and undergo a credit check. The bonding company will then assess your risk and determine the premium.

It’s possible to get a surety bond with bad credit, but it may be more challenging and expensive. Some surety companies specialize in high-risk applicants, while others may require collateral or higher premiums.

The time it takes to obtain a surety bond can vary. Some bonds can be issued quickly, while others may require more underwriting and documentation. It’s best to start the application process well in advance of your bond’s required date.

If you fail to meet your obligations as outlined in the bond agreement, the obligee can make a claim on the bond. The surety will then investigate the claim and, if valid, compensate the obligee. However, you are ultimately responsible for repaying the surety for any claims paid, plus associated costs and fees.

Surety bonds are typically issued for a specified term, and they can be canceled by the principal or the surety under certain conditions. However, canceling a bond prematurely may have financial consequences and could result in a claim against the bond.

The duration of a surety bond depends on the type of bond and the terms specified in the bond agreement. Some bonds are for a specific project or period, while others may be continuous and require annual renewal.

These FAQs provide a general overview of surety bonds and can help individuals and businesses understand the basics of this important financial instrument. Specific requirements and details may vary depending on the type of bond and the jurisdiction in which it is required.

If you have an insurance question, please submit it here. Someone will get back with you within 24 hours.