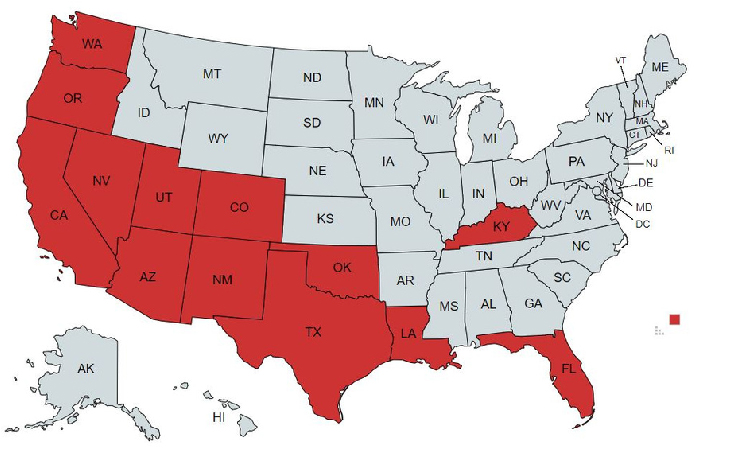

Territories We Serve: AZ, CA, CO, FL, KY, LA, NM, NV, OK, OR, TX, UT, WA

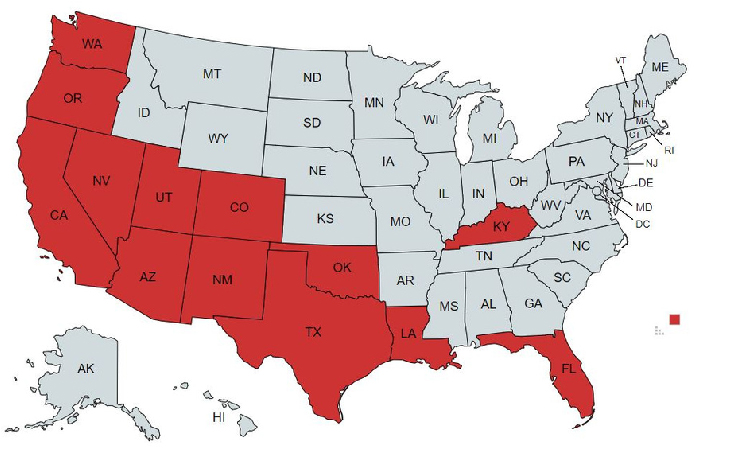

Territories We Serve: AZ, CA, CO, FL, KY, LA, NM, NV, OK, OR, TX, UT, WA

At Inspirion Insurance solutions we talk to hundreds of clients and potential clients every month. When discussing their current Auto insurance,

there is one answer we regularly get- “I have full coverage.” What does this mean?

The wording Full Coverage seems to imply the insured is covered in the event of any type of Auto Loss or accident. Is this really true? However,

Full Coverage is a misnomer in the insurance industry. All it really means is you have the required coverage, but doesn’t really address coverage limits.

For example, a Nevada driver has state minimum coverage below:

Technically this driver has “Full Coverage” but let’s say they cause an accident with injury to the other driver. Hospitals charge around $7,500/day if they keep you there. Throw in any tests, medicine or surgeries and this number will exceed $15,000 very quickly. Or worse yet if in this accident resulted in death, would $15,000 be enough? All of us would agree if it was our family member $15,000 would not be enough.

There are several scenarios where the “full coverage” in this example would not be enough. This is why it is important to sit down with your agent to discuss coverage and how they impact you and your family. Don’t assume that you have the right coverage. It can actually cost you more in the long run.

Contact Inspirion Insurance Solutions today for a free insurance review.

702-979-3299

jeff@inspirioninsurance.com

PREVIOUS POST

NEXT POST

Is Jewelry Covered by Home Insurance? »